What You’ll Learn

- Use these FAQs to get quick answers to some of our most common questions about Mobile and Online Banking.

- For more on the many helpful features in Mobile and Online Banking, check out our Tutorials page.

How do I get help logging in for the first time?

How do I get help logging in for the first time?

See our step-by-step tutorial.

How do I download the Salal Mobile Banking app?

To download the Salal Mobile Banking app, go to the Apple or Google Play app store on your device. Search for “Salal Credit Union” and install the app.

When I try to log in for the first time, I can’t get past the “Confirm Contact Information” page. What should I do?

The email and phone number we have on file for you may not be up to date. This information is necessary to enroll in Digital Banking. Please call our Virtual Branch at 800.562.5515 for further assistance.

Why can’t I log into Online Banking on my computer or laptop right now?

Here are some things to check:

- Make sure your internet connection is working properly.

- You may need to change the security settings for your web browser.

- It could also be that your current web browser is not compatible.

- We recommend using the most recent Edge, Chrome, Safari, or Firefox versions.

- Check your browser settings and ensure that cookies are enabled. Also confirm that your computer is configured to connect to Online Banking.

Why can’t I access Mobile and Online Banking or Bill Pay?

If you have never successfully connected to Digital Banking or Bill Pay, and this is your first time using Mobile or Online Banking, follow the instructions in this helpful tutorial video for first-time users. Also see our Setting Up and Using Bill Pay tutorial.

If you’ve followed the steps in the tutorial video and are still unable to log in to Online Banking, the security settings on your browser may need to change or your current web browser may not be compatible. We recommend using the most recent versions of Edge, Chrome, Safari, or Firefox. Check your browser settings and make sure that cookies are enabled and your computer is configured to connect to Online Banking.

If you are having trouble logging into your Mobile Banking app, make sure your device is running the most recent operating system and that you have downloaded the most up-to-date version of the Mobile Banking app.

If you continue to have issues, call our Virtual Branch at 800.562.5515 for assistance.

How do I verify my mobile device for SMS text messages for Mobile or Online Banking multi-factor authentication?

To use SMS text messages for Digital Banking login authentication, you will need to have a mobile device that can receive SMS text messages, and you will need to verify your device through Mobile or Online Banking. For instructions, see our Online Banking Multi-Factor Authentication Options tutorial.

How do I set up SMS text notifications?

How do I set up SMS text notifications?

- Go into Settings -> Contact and ensure you have a mobile phone number entered.

- Check the box that says I Would Like To Receive SMS Text Messages To This Number.

- You will then receive a code sent to that number so you can verify it.

Can I reset my Mobile and Online Banking password?

For step-by-step instructions on resetting your Digital Banking password see our Password Reset tutorial.

If you continue to have issues, call our Virtual Branch at 800.562.5515 for assistance.

What’s the difference between linking external accounts (account aggregation) and setting up transfers from external accounts?

The account aggregation feature in Mobile and Online Banking allows you to link your accounts at other financial institutions to monitor your balance and transactions on your accounts at other financial institutions. Learn how to Link External Accounts.

You can also set up transfers from your external accounts at other financial institutions to your Salal account to make loan payments, move funds between accounts, or send money to another Salal member. To learn how, see our Transfer from Account to Account tutorial.

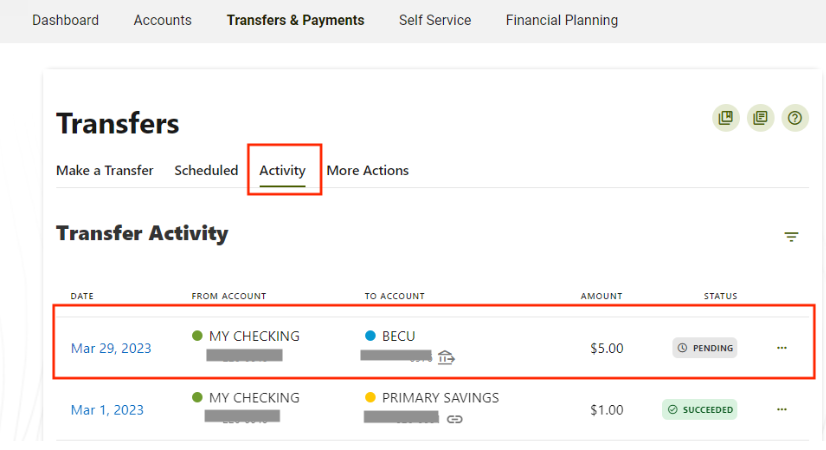

Why can’t I see my external transfer in the “Scheduled” transfer tab?

Because external transfers go through ACH (Automated Clearing House) network, they do not show in the scheduled transfer tab and will not appear on the calendar. However, you can see the status of external transfers under the “Activity” tab.

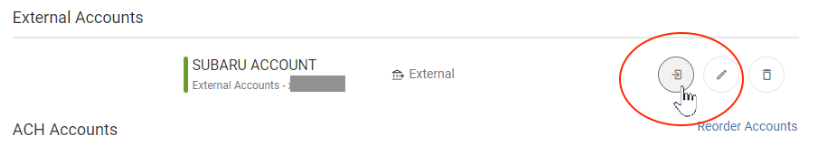

My external account has a red exclamation mark next to it—what does that mean?

Your login credentials for your external account likely need to be updated. To do this, follow these steps:

- Click on your name in the upper right corner and select Settings.

- Go to the Account Tab

- Under External Accounts, go to the account that needs to be updated.

- Select the first icon on the right-hand side (see below).

- Enter your login credentials for that financial institution again. Everything should re-sync (this may take a few minutes).

Can I lock my card if I can’t find it?

Yes. If your card has been lost or stolen, log in to Digital Banking and go to Accounts -> Card Controls to lock your card.

How can I let Salal know I am traveling and will be using my card?

To set up your own travel notice in Mobile and Online Banking, follow these steps:

- Go to Accounts –> Card Control.

- Select the card you would like to add a travel note for.

- Select Travel Notice and add your travel details, then hit save.

If you are traveling to multiple destinations, please follow these same steps for each destination.

You can also call our Virtual Branch at 800.562.5515 and we can set up a travel notice for you.

How can I make my loan payment?

See our article “Convenient Ways to Make a Loan Payment.”

How do I make a principal only payment on my loan?

See our article “How to Make a Principal-Only Loan Payment.”

How do I find my full 13-digit account number?

To find your full 13-digit account number, log in to digital banking. Select the account you need, then go to “Show Details” in the mobile app or the “Account Details” tab in Online Banking. You’ll find your full MICR account number will be listed there, along with Salal’s routing number (325081610).

Need your member number? It’s the last six digits of your MICR account number.

How can I delete my Salal digital banking username and profile?

If you would like to delete your Salal digital banking username & digital profile, please call our Virtual Branch at 800.562.5515. Salal Credit Union is required to retain personal information in certain circumstances, including:

- Personal information needed to service accounts, applications or financial services you or your family members maintain with us.

- Personal information for the period required to comply with federal, state or local laws.

- Personal information needed in relation to active or potential legal claims.

To learn more about the personal information we collect, how we share it, and other general privacy information, visit our Privacy and Security page.

Need more help?

Visit our Resources page or call our Virtual Branch at 800.562.5515.