Ready to seize control of your financial future this year? We’re excited to introduce SavvyMoney’s latest tool—the Financial Checkup. In today’s digital world, where taking charge of your finances is crucial, this tool acts as your guide toward a stronger financial future.

Understanding the Financial Checkup

At its core, Financial Checkup is a comprehensive system, nestled in the SavvyMoney widget within Mobile and Online banking, designed to transform how you perceive and manage your finances.

How It Works

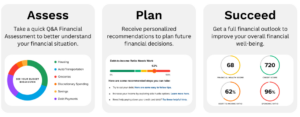

Financial Checkup isn’t just about numbers; it’s about understanding your financial landscape in a way that empowers you. With a simple click on “Take An Assessment,” you delve into an intuitive Q&A session that navigates through household spending, financial planning, and monthly budgeting. The questions range from multiple-choice to free-response, tailored to gain insights into your current and future financial standing.

Unveiling Insights and Actionable Recommendations

Once you’ve completed the assessment, you’ll receive your Financial Health Score, Credit Score, Debt-to-Income Ratio, Spending Ratio, and a Monthly Budget Summary. But the insights don’t stop there—you’ll also receive personalized recommendations. These actionable steps are your blueprint to reduce spending and optimize debt-to-income ratios, ultimately paving the way for a more secure financial future.

Commit to Your Financial Journey

The Financial Checkup isn’t just a tool; it’s an opportunity to gain insights, receive personalized recommendations, and embark on a journey towards financial wellness. Explore the Financial Checkup tool from by logging into your digital banking account and check out the “Financial Checkup” feature.

Log in to digital banking to see your Financial Health Score.