What You’ll Learn

- Discover why Salal digital banking is like having a financial coach on call 24/7.

- Learn how to take your financial assessment and find out your FinHealth Score.

Ok, yeah. We might not want a financial coach actually living in our phone—that could get awkward. However, with the Financial Wellness feature in Salal digital banking, you can start exactly where any good financial coach would start—assessing your current financial situation.

Ok, yeah. We might not want a financial coach actually living in our phone—that could get awkward. However, with the Financial Wellness feature in Salal digital banking, you can start exactly where any good financial coach would start—assessing your current financial situation.

We all know what it’s like to stress about money. But did you know that financial stress can impact your physical or mental health? It’s true. WebMD even has an article on the topic. Financial hardships often result in stress, which can lead to physical health issues like heart disease and weakened immune systems. It can also lead to mental health issues such as anxiety and depression. Financial instability can limit access to quality healthcare, delay necessary treatments, and influence poor dietary and lifestyle choices, contributing to conditions like obesity. Moreover, money-related stress can disrupt sleep and even promote harmful coping behaviors like substance use.

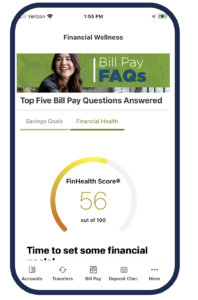

Taking a financial health assessment can be a crucial first step towards achieving financial wellness. It offers you a snapshot of your current financial status, covering aspects such as income, expenses, savings, and debts. That’s why we included a financial health assessment in Salal digital banking. The assessment leverages the Financial Health Network’s FinHealth Score Toolkit and takes just a minute or two to complete. When you’re finished, it gives you your FinHealth Score, along with some context about what the score means. It also recommends further resources you might want to check out.

Ready to Find Out Your FinHealth Score?

To take your financial health assessment, log in to Mobile or Online Banking and go to the Financial Planning section in the main menu. From there, go to the Financial Wellness feature and select Financial Health. Then you’re ready to go.

Once you know your score, you can stay within the Financial Wellness feature and move over to Savings Goals to set up some targets to work towards. You can also stay in digital banking and head over to SavvyMoney, where you can find a number of tools for monitoring and improving your credit.

Updating Your FinHealth Score

You can track your progress on the path towards financial wellness by retaking your assessment to update your FinHealth Score. Follow one of the links below to retake your assessment.