A message to our members

2023 was a year in which Salal Credit Union showed resilience and adaptability as we faced many challenges. Some of these challenges we expected and planned for, like high interest rates—which continued their historically swift rise throughout most of the year. Other challenges were harder to anticipate, such as the uncertainty and unease for consumers and businesses brought on by the unfortunate failure of Silicon Valley Bank. But if there’s one thing we’ve learned in the years since the beginning of the COVID pandemic, it’s to expect the unexpected.

Despite these economic headwinds, we’re pleased to report that Salal ended the year with a net income of $6.7 million. Member deposits grew $34 million, while total deposits, including non-member deposits, grew $11.7 million, to a total of $1.04 billion. These members benefited from some of the highest savings rates we’ve offered in decades. This growth in deposits also helped ensure the credit union remained fiscally sound and ready to serve our members and communities during these uncertain economic times.

As we predicted, 2023 presented us with a challenging lending market, with lower-than-normal growth due to high interest rates. We were able to plan for this slowdown, and the reduction of net income that came with it, by working diligently to reduce expenses and boost efficiencies across the organization. Although higher interest rates meant fewer borrowers, we were still able to help 6,451 members make improvements to their homes or invest in solar energy. The 1,846 home solar systems we financed will prevent an estimated 14,391 metric tons of CO2* emissions in 2024 alone—and help our members save money on their utility bills for the foreseeable future.

Brian Luong

Chair, Salal Board of Directors

Russell E. Rosendal

President and

Chief Executive Officer

When our members experienced economic hardships, we worked closely with them to ensure they could make their loan payments and gain access to assistance. The dedication and empathy showed by our Member Solutions team, along with the hard work of our loan underwriting teams, has led to Salal once again having a loan delinquency and charge-off rate significantly below our Washington state peers. We expect this good credit quality to continue in the coming years.

This past year, we continued to proudly serve the cannabis industry. Salal Business Services opened 291 new accounts as part of our initiative to expand our support for cannabis industry businesses. We also stepped up our outreach to cannabis industry professionals. We redoubled our efforts to educate this under-served community on the importance of having a dependable, cannabis-friendly banking account. We also worked to build awareness about the many personal banking options Salal has available to cannabis business owners and employees.

The banking crisis in the spring of 2023 was an understandable cause for concern for our business members—especially those in the cannabis industry. Our Business Services team proactively reached out to business members, providing businesses with concrete information about why their deposits at Salal were secure. We also worked with members to help them maximize their NCUA deposit insurance coverage.

In September, Salal stopped charging non-sufficient funds (NSF) fees and overdraft transfer fees to our personal banking members. We also changed how we assess fees for Courtesy Pay automatic overdraft protection to make it less likely that a fee will be charged. Eliminating these fees will collectively save our personal banking members around $346,000 a year and remove a potential obstacle that can lead to someone losing access to banking services.

In 2023, we continued investing in digital technology to make banking safer, easier, and more accessible for our members. We launched a new SalalCU.org website that features a wider range of tutorials, financial wellness resources, and interactive tools. We also kept our focus on data security and privacy. As a credit union that must meet federal and state regulations, we embrace the higher security standards we’re held to compared with unregulated Fintech services. Our systems go through extensive internal and independent testing. We also have dedicated teams that work specifically to protect members from fraud.

Thanks to the support of our members, we were once again able to make good on our commitment to give 5% of our net income to help people and causes in the communities we serve. This past year, we donated $327,157 in support to 109 organizations, including HealthPoint, Rebuilding Together, GRID Alternatives, UW Nursing, and King County Nurses Association. Since 2017, we’ve given $2.4 million in charitable donations to healthcare, housing, and social welfare organizations in areas we serve. See the Community Impact section of this report to learn more about the difference Salal members made in 2023.

As we plan for the rest of 2024, we see cause for both caution and optimism. We expect the economic landscape to be challenging at times. As we navigate this economic turbulence, we’ll continue to focus on helping members grow their savings and cultivate financial well-being. With the Federal Reserve signaling modest rate cuts, we’re looking forward to helping more of our members save money with affordable mortgages, home improvement loans, electric vehicle financing, and much more. We’re also excited about more technology upgrades coming this year. These improvements will enhance our ability to provide members with timely support and empower them to get the most out of the many benefits that come with Salal membership.

Finally, we’d like to express our gratitude. Without the trust and loyalty of our members and the hard work of our dedicated Salal team, we wouldn’t be the strong and dynamic credit union we are today. On behalf of our leadership team and our all-volunteer Board of Directors, we thank you for being a member of Salal Credit Union. We’re grateful for the opportunity to serve your financial needs and we look forward to working together to build a brighter and more prosperous future for everyone in this coming year.

Sincerely,

Brian Luong, Chair, Salal Board of Directors

Russell E. Rosendal, President and Chief Executive Officer

Chad Cheney

Chair, Supervisory Committee

Supervisory Committee Report

The mission of the Supervisory Committee is to oversee the operations of the credit union to protect the investments of its members. The Committee meets with management, independent external auditors, and governmental examiners to ensure the credit union operates in compliance with the requirements of state and federal regulatory agencies.

The Supervisory Committee meets regularly with management to review and evaluate the credit union’s operating policies; ensure internal controls are defined, effective, and followed; review and recommend policy changes to the Board of Directors; and ensure sound operating procedures are adhered to in accordance with established policies.

The Supervisory Committee works with the credit union’s internal auditor to make certain the activities of the internal audit department are reported to the Board of Directors. The internal auditor’s reports and recommendations have increased the Committee’s visibility and effectiveness internally and externally. This is reflected in the positive feedback received from Salal surveys, regulators, and independent auditors. The Committee also serves as the Board of Director’s liaison with the independent auditors in carrying out the annual audit opinion, as well as reporting the auditors’ findings and recommendations to credit union members at the annual meeting. In the 2022 audit, our independent auditors, Moss Adams LLP, CPAs, issued an unqualified opinion.

The Supervisory Committee finds the reporting and operating procedures of the credit union, as well as the actions and policies of the Board of Directors, committees, and management, to be in compliance with applicable laws and regulations.

Board of Directors

Brian Luong

Chair

Alan Lederman

Vice Chair

Catherine Bailey

Secretary

Nishat Akhter

Sophie Brougham

Quynh-Anh Nguyen

Karen Schartman

Joe LePla

Emeritus Board Member

Senior Leadership

Russell E. Rosendal

President & CEO

Robert Schweigert

SVP, Chief Lending Officer

Judy Loveless-Morris

SVP, Chief Diversity & People Officer

Randy Cloes

CMA, SVP, Chief Financial Officer

Skott Pope

SVP, Chief Digital & Strategy Officer

Salal Committees

Executive

Alan Lederman

Catherine Bailey

Russell E. Rosendal

Supervisory

Eric Oliner

Catherine Bailey

Annette Murphy

Andrew Makori

Loan

Kevin Knowles – Chair

Magnus Andersson

Daniel Hirsty

Doug Larson

Russell E. Rosendal

Robert Schweigert

Randy Cloes

Governance

Catherine Bailey – Chair

Brian Luong

Alan Lederman

Sophie Brougham

Nishat Akhter

Quynh Nguyen

Asset/Liability

Alan Lederman – Chair

Sophie Brougham

Jason Kunkel

Daniel Hirsty

Russell E. Rosendal

Robert Schweigert

Randy Cloes

Skott Pope

Kari Stenslie

Brett Ballman

Risk

Randy Cloes – Chair

Joe LePla

Sophie Brougham

Nishat Akhter

Kristin Burnett

Russell E. Rosendal

Robert Schweigert

Technology Advisory

Quynh Nguyen

Russell E. Rosendal

Skott Pope

Matt Vance

Christian Grunert

Matthew Heitland

Keith Price

2023 Financials

|

YEAR END

|

LOANS, NET ($ in millions)

|

|---|---|

|

2023

|

991

|

|

2022

|

1,038

|

|

2021

|

702

|

|

2020

|

648

|

|

YEAR END

|

ASSETS ($ in millions)

|

|---|---|

|

2023

|

1,218

|

|

2022

|

1,279

|

|

2021

|

1,077

|

|

2020

|

993

|

|

YEAR END

|

DEPOSITS ($ in millions)

|

|---|---|

|

2023

|

1,040

|

|

2022

|

1,028

|

|

2021

|

949

|

|

2020

|

871

|

|

YEAR END

|

TOTAL EQUITY ($ in millions)

|

|---|---|

|

2023

|

88

|

|

2022

|

79

|

|

2021

|

86

|

|

2020

|

79

|

Summary Financial Statements

Table scrolls right.

|

ASSETS ($ IN 000'S)

|

2023

|

2022

|

2021

|

|---|---|---|---|

|

Cash and Cash Equivalents

|

26,761

|

27,181

|

149,412

|

|

Investments

|

139,364

|

152,972

|

168,687

|

|

Loans to Members

|

1,000,746

|

1,051,282

|

711,681

|

|

Less: Allowance for Credit Losses

|

(10,033)

|

(13,236)

|

(9,511)

|

|

Loans, net

|

990,713

|

1,038,046

|

702,170

|

|

Fixed Assets, net

|

28,078

|

30,131

|

32,392

|

|

Federal Share Insurance Fund Deposit

|

6,990

|

5,333

|

5,267

|

|

Other Assets

|

25,874

|

25,291

|

18,907

|

|

Total Assets

|

1,217,780

|

1,278,954

|

1,076,835

|

|

LIABILITIES AND MEMBERS' EQUITY ($ IN 000'S)

|

2023

|

2022

|

2021

|

|---|---|---|---|

|

Savings

|

122,816

|

164,677

|

175,593

|

|

Checking

|

425,410

|

513,524

|

563,235

|

|

Money Markets

|

121,888

|

100,381

|

125,569

|

|

Certificates

|

316,580

|

174,088

|

85,003

|

|

Non-Member Certificates

|

52,962

|

75,251

|

-

|

|

Total Deposits

|

1,039,656

|

1,027,921

|

949,400

|

|

Borrowings

|

63,825

|

146,619

|

14,034

|

|

Other Liabilities

|

25,894

|

25,526

|

27,484

|

|

Reserves, Undivided Earnings & Other Comprehensive Income

|

88,405

|

78,888

|

85,917

|

|

Total Liabilities & Members' Equity

|

1,217,780

|

1,278,954

|

1,076,835

|

|

INCOME STATEMENT ($ IN 000'S)

|

2023

|

2022

|

2021

|

|---|---|---|---|

|

Interest on Loans to Members

|

53,408

|

39,935

|

29,724

|

|

Interest on Investments & Cash Equivalents

|

5,655

|

3,566

|

1,585

|

|

Total Interest Income

|

59,063

|

43,501

|

31,309

|

|

Interest Paid to Members

|

14,812

|

2,242

|

1,028

|

|

Interest on Borrowings

|

4,708

|

2,883

|

193

|

|

Total Interest Expense

|

19,520

|

5,125

|

1,221

|

|

Net Interest Income

|

39,543

|

38,376

|

30,088

|

|

Provision for Credit Losses

|

41

|

5,002

|

274

|

|

Net Interest Income After Provision for Credit Losses

|

39,502

|

33,374

|

29,814

|

|

Fee and Other Income

|

17,349

|

19,910

|

24,321

|

|

Gains/Loss from Sale of Assets

|

-

|

1,327

|

-

|

|

Total Non-Interest Income

|

17,349

|

21,237

|

24,321

|

|

Employee Compensation and Benefits

|

31,080

|

30,483

|

28,169

|

|

Operations

|

14,748

|

13,576

|

12,240

|

|

Occupancy

|

4,305

|

4,358

|

4,520

|

|

Total Non-Interest Expense

|

50,133

|

48,417

|

44,929

|

|

NET INCOME

|

6,718

|

6,194

|

9,206

|

All 2023 financial numbers presented are unaudited. All 2021 and 2022 financial numbers are audited. Reclassification – Certain reclassifications have been made to conform to the current-year presentation. The reclassifications had no impact on previously reported net income or members’ equity. Audited financial statements are available upon request.

Community Impact 2023

Power in Together

The credit union movement is built upon the principle of “people helping people.” At Salal, we’ve seen firsthand how small actions, when added together, can make a big difference. This past year, our credit union proved yet again that there truly is “Power in Together.” Whether it was expanding access to essential banking services for underserved communities or supporting important causes like clean energy and housing security, our members amplified their impact in 2023 by choosing to do their banking and financing with Salal. Here’s a look at some of the good things your membership helped make possible this past year.

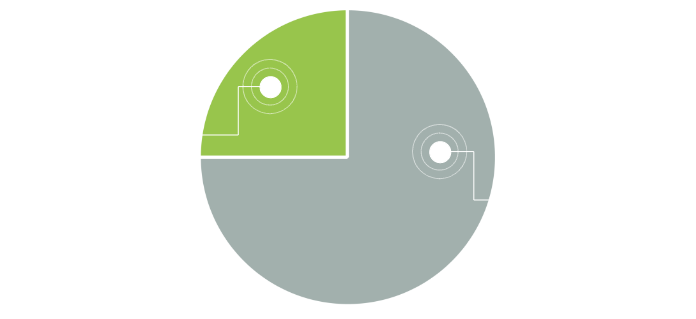

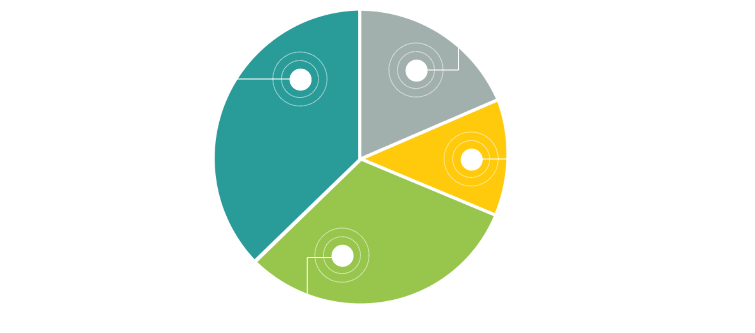

2023 Overall Giving

2023 Giving Breakdown

Total Giving:

2023

Giving in Action

$37,000

in nursing scholarships and career development.

$10,000

towards the CU AID Maui Wildfire Relief Fund.

$39,000

in support for HealthPoint community health network.

$23,400

in employee donations with Salal matching funds.

Giving & Impact Highlights

At Salal, we are committed to helping build thriving communities, focusing on wellness, equity, and sustainability. Guided by our all-member Board of Directors, our approach to giving focuses on healthcare, housing insecurity, social equality, and renewable energy. We also continue to empower our members to lower their carbon emissions with affordable financing for solar energy and rate discounts for electric vehicles.

Healthcare

Housing Insecurity

This past year, we continued our collaboration with Rebuilding Together. The ongoing support from Salal and the Salal Foundation once again focused on She Builds, a program focused on advancing the housing and community issues affecting women. Salal’s support funded seven capacity-building support grants of $10,000 to launch or expand existing She Builds programs. These funds helped improve the lives of homeowners in Texas, California, Ohio, and Washington by providing essential home repairs aimed at allowing our shared neighbors to live in a safe and healthy home.

"Because of the grant from Salal, we were able to empower low-income female seniors in homes located in the historically black areas in Southeast San Francisco, where the neighborhoods are primarily under-resourced and excluded. We were able to complete critical repairs to more female households in San Francisco and host a successful She Builds-led project during our Fall Build Days. The purpose of this project was to support connecting children with nature and elevating early childhood development centers.”

Crystal Wan

Development Coordinator, Rebuilding Together San Francisco

SOCIAL equity

In 2023, we welcomed seven students as our second cohort to the Salal Academy program. Salal Academy is a 4-week immersive job-prep training program designed and facilitated by the Salal team.

The program features a mix of classroom-based learning, independent activities, in-branch training, and professional development. Participants gained industry and product knowledge, practiced excellent member service, processed transactions using simulated banking software, participated in mock job interviews, and observed live operations at our branches. Learners received a $1,000 stipend when they completed the program. One of the program’s main goals is to reach people in communities that have traditionally been under-represented in the banking world, letting them know about the many opportunities available in the world of financial services. We’re looking forward to welcoming our next cohort in 2024.

Renewable energy

Part of our support for renewable energy this past year included over $22,500 in funding for GRID Alternatives, an organization that works to build community-driven renewable energy projects that promote both economic and environmental justice. Salal’s financial support this year funded four solar industry workforce development programs in California and Colorado, where a combined 22% of our members live. These programs offered 60 trainees hands-on job learning opportunities that focused on making the solar industry more accessible and inclusive for groups that have been historically underrepresented, including women, people of color, and those impacted by the criminal justice system.

Expanding Access to Solar Power

Salal funded 1,846 home solar systems in 2023 through our Dealer Direct lending program. To put this in perspective, these solar systems will together produce an estimated 20,306,000 kWh of emissions-free electricity for homeowners—and that’s just in the first year. All this clean power can potentially prevent up to 14,391 metric tons* of greenhouse gas emissions. That’s the equivalent of 36,890,766 miles driven by an average gasoline-powered car. Or, if you prefer a greener example, it’s equivalent to the carbon sequestered by 237,948 tree seedlings grown for 10 years.

Source:

*Carbon emissions statistics based on average U.S. solar panel energy production, system size, and household energy usage. Emissions data estimated with the EPA’s CO2 emissions calculator.